Damien Klassen| LIvewire| 12 July 2022

Australian property prices: Interest rates are just one part of the story – Damien Klassen | Livewire (livewiremarkets.com)

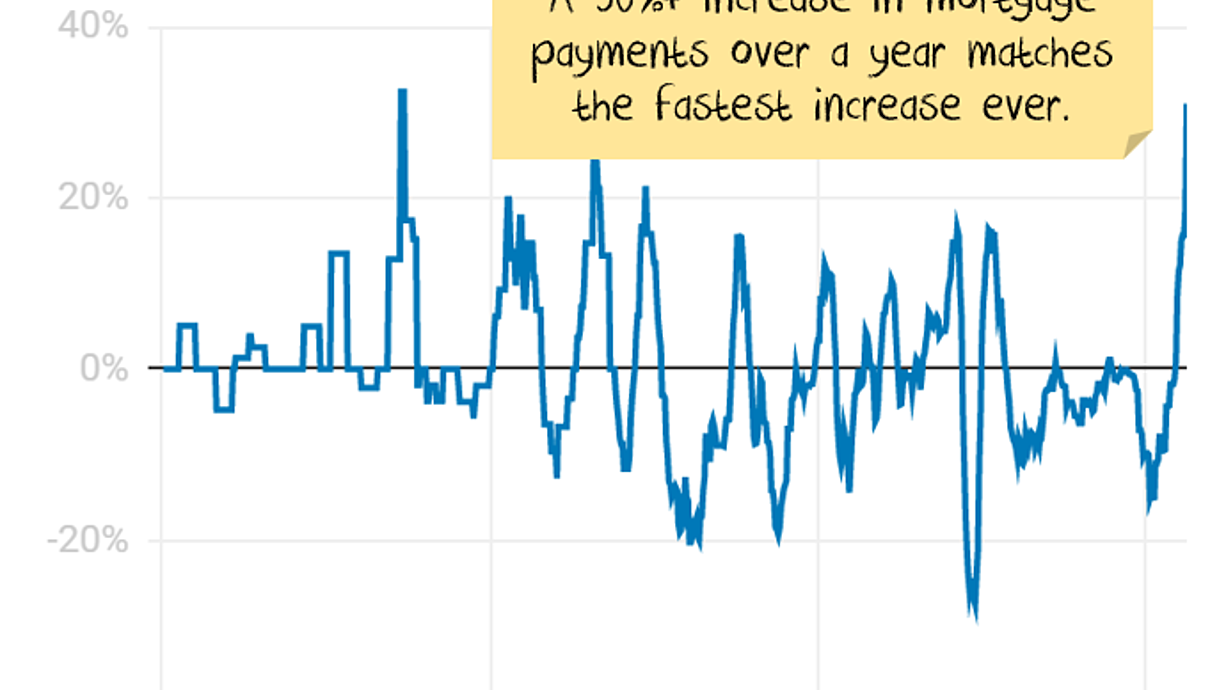

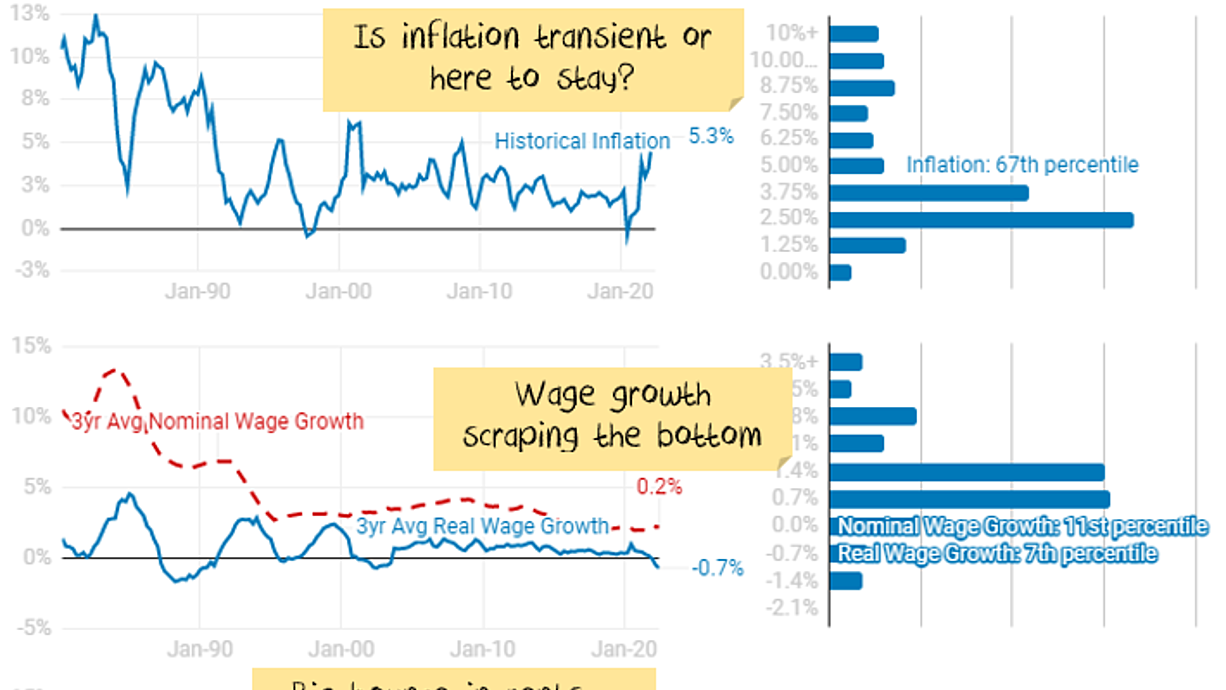

Australian property market prices are falling, and rents are rising rapidly. Interest rates are rising even faster. In terms of mortgage payments, a 30%+ increase in one year is higher than any other time since the 1970s. And the RBA is guiding to more rate rises to come.

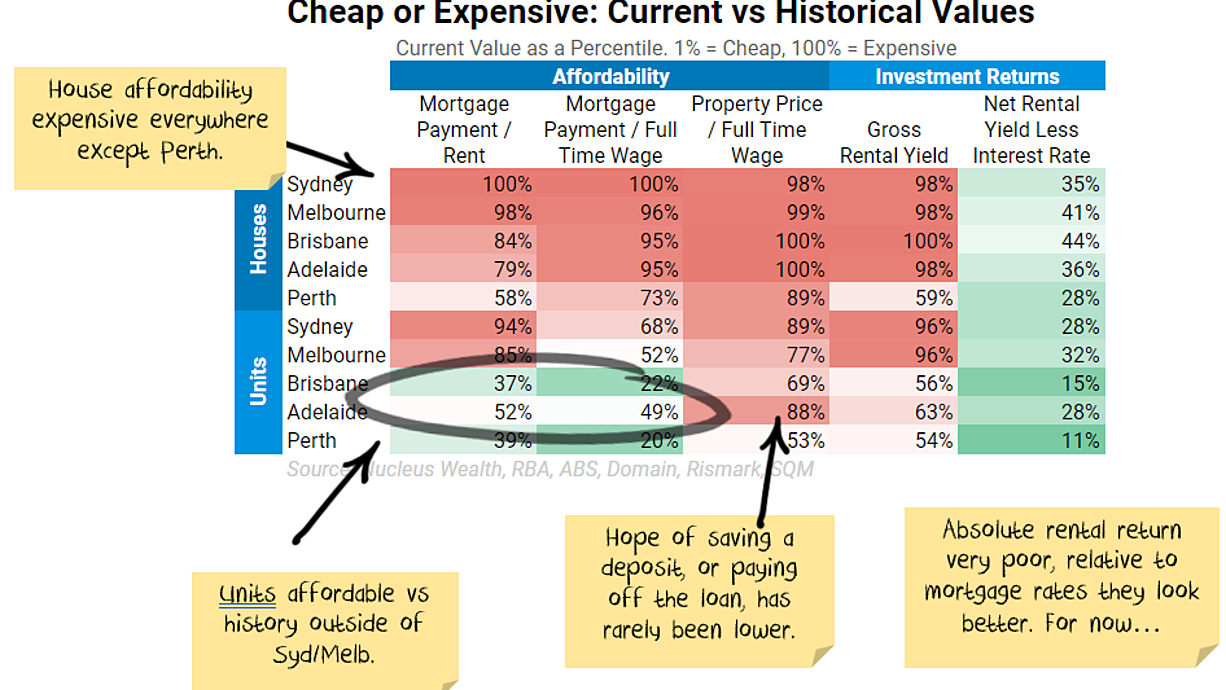

Affordability was already as poor as it had ever been in some markets before the rate rise.

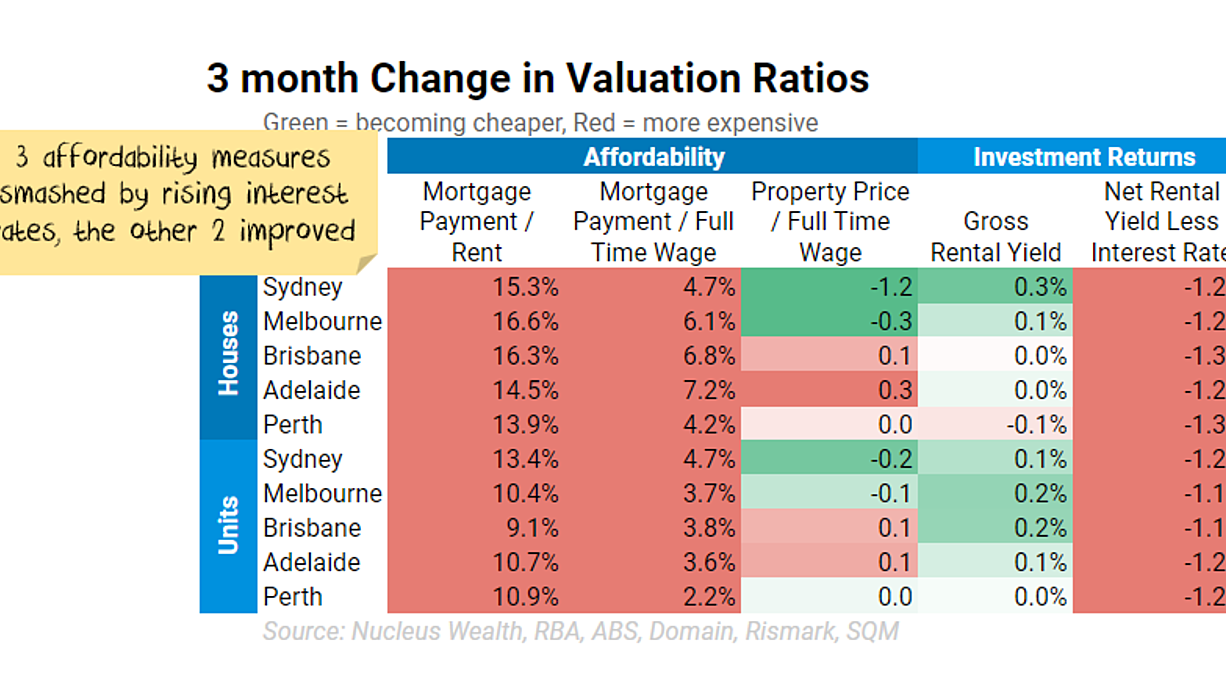

Housing valuation and affordability statistics worsened over June. For investors, rental yields improved a little as rents rose while prices fell. But yields are still very low vs history, and interest rate rises would have swamped any gains for investors looking to borrow.

Markets are pricing in an extraordinary 7%+ mortgage rates over the next few years. That would double the 2021 mortgage repayments for a 20% deposit mortgage. Given Australia has (a) the second most indebted consumers in the world and (b) mostly variable interest rates, it seems unlikely that interest rates can rise that far without crashing the property market before that.

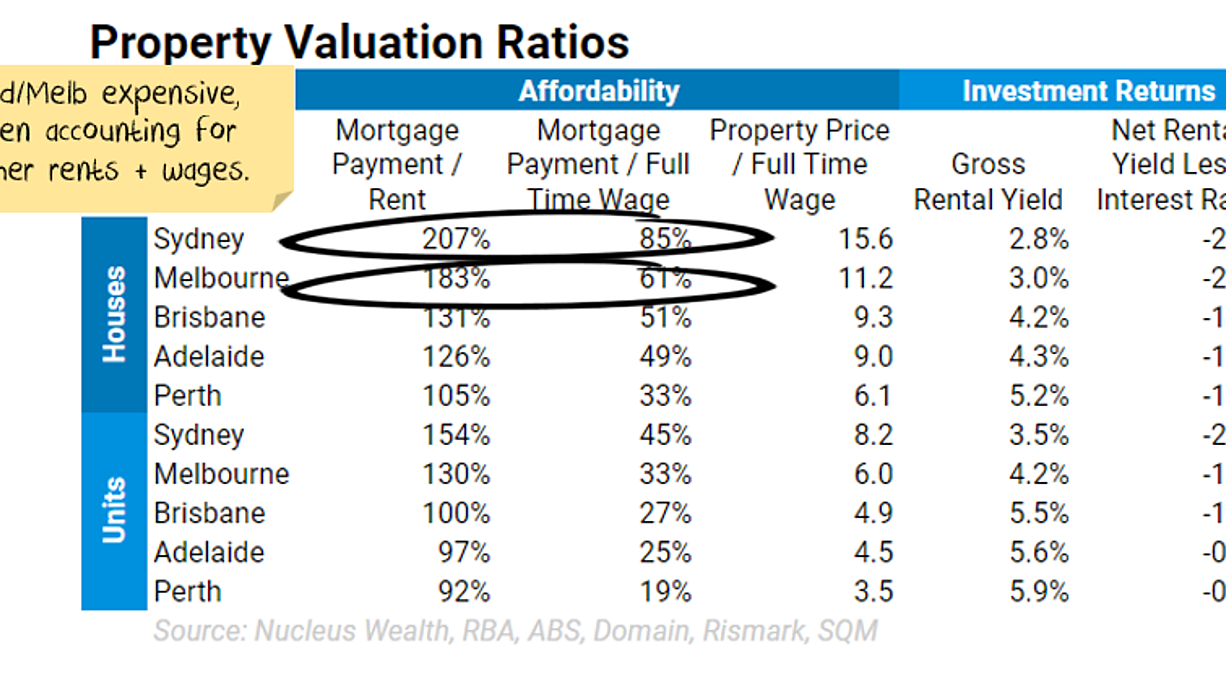

We run an Australian property market calculator to help investors or potential homeowners determine the returns on Australian property. The idea we want to illustrate is that there are a number of key inputs into housing valuation. Interest rates are the most important, but the other limiting factors are:

- Mortgage Payments to Rent: comparing the cost of a mortgage with the cost of renting the same house. Using this ratio to constrain house prices, we assume that people will prefer to rent when the ratio gets high rather than buy.

- Mortgage Payments to Wages: assuming when the ratio gets high, people rent because they cannot afford to buy.

- Property Prices to Wages: assuming when the ratio gets high, people rent because they cannot save enough money to afford a deposit. We treat this as less important than the above two ratios.

- Rental Yield: Rental yield is the annual rent divided by the property price. By using this ratio to forecast prices, you are assuming when the ratio gets low investors will not buy property as they are not getting a return that is high enough.

Detailed charts for the above locations can be found in the property detail update. For more on how and why we use these ratios see our residential real estate forecasting methodology.

AUSTRALIAN MORTGAGE RATES ARE ON THE MARCH.

There are effectively two different interest rates over the past few years, the floating rate and the three-year fixed rate.

- The floating rate is determined mainly based on the Reserve Bank of Australia. It reduced the floating rate to 0.1% in March 2020, which reduced the standard variable rate from banks to around 4.5%. Discounted variable rates made it as low as 3.45% and have now risen to 4.2%.

- In March 2020, the Reserve Bank also introduced a facility where they lent directly to the banks at 0.1% for three years. This facility (and other market interventions) allowed banks to drop three-year fixed mortgages to around 2%. Its name is the Term Funding Facility. It ended in June last year, and now three-year mortgages are over 5%.

When you adjust the factors in our property market calculator, you find that with higher interest rates, you would have to put in never-seen-before valuation ratios for house prices not to fall.

Macro factors

Australian Property Market Outlook

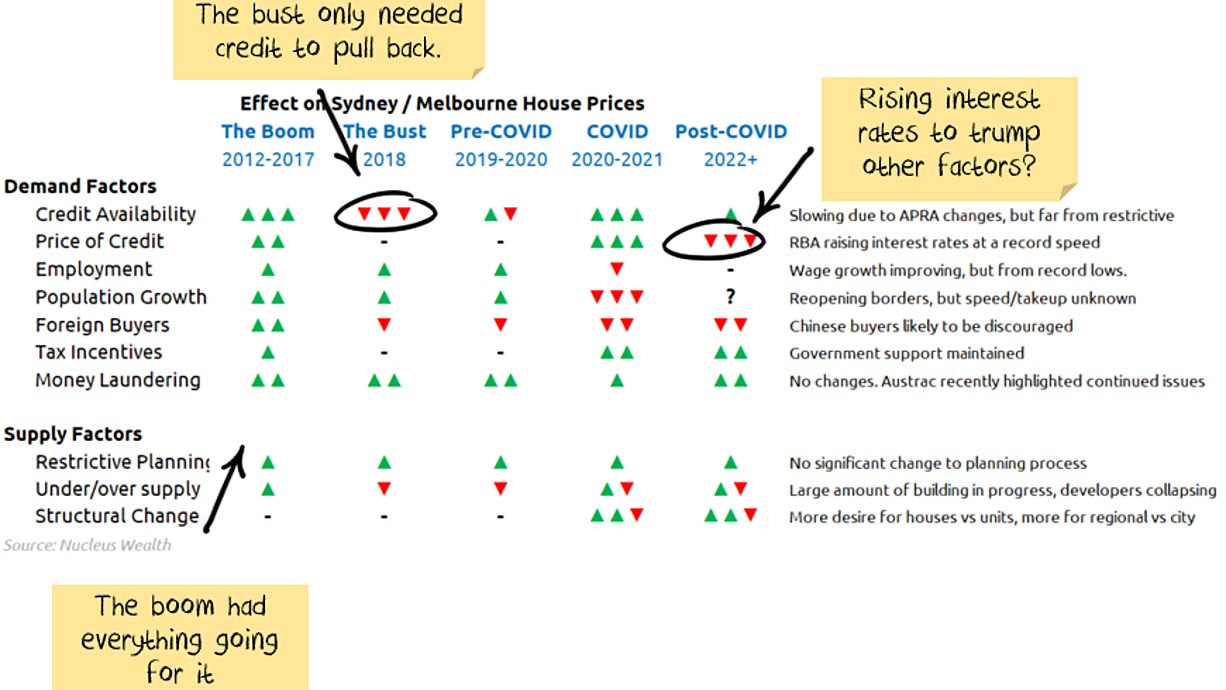

Property prices have clearly started to fall in the more up-to-date data. Interest rates now rapidly rising and the RBA is talking about more.

In my view, rising rates will trump the other factors, but there are many opposing forces at play.

On the one hand, plummeting immigration, pandemic disruptions and the end of eviction/mortgage payment moratoriums aren’t helping. A boost in supply is in progress, spurred by new home building. But property developers are falling over left and right, caught between rising costs and fixed-price contracts. Rental growth jumped again this quarter, but the last few years have been very weak. And Australia starts with a larger private debt burden than just about any other country.

On the other hand, we have a burning political desire to keep Australian property market prices high and pump more debt into the economy. Wage growth is low, meaning the interest rate rises that the market is pricing may not eventuate. There is a structurally higher demand for houses vs units due to the fear of more lockdowns. There is a structurally higher demand for bigger houses, more rooms or fewer housemates, given the move to work from home.

Rising rents and falling prices are usually a sign to start looking at the property market. But with the speed of the interest rate rises already and more to come, it might be prudent to wait. Keep in mind that interest rates take some time to take effect. If the RBA is wrong then they might not realise it before a recession is already here. The most important issue right now is interest rates.

Our methodology

Nucleus Wealth has compiled this data using a range of different sources.

We use Domain for more recent data on quarterly property prices and rents, and cross-checked with SQM to fill any short-term moves. Older information is from Rismark and the Australian Bureau of Statistics to fill the time series.

For economic data, we use either Reserve Bank of Australia or the Australian Bureau of Statistics data. For older data, we need to estimate some factors due to differing definitions over time.

Recent Comments