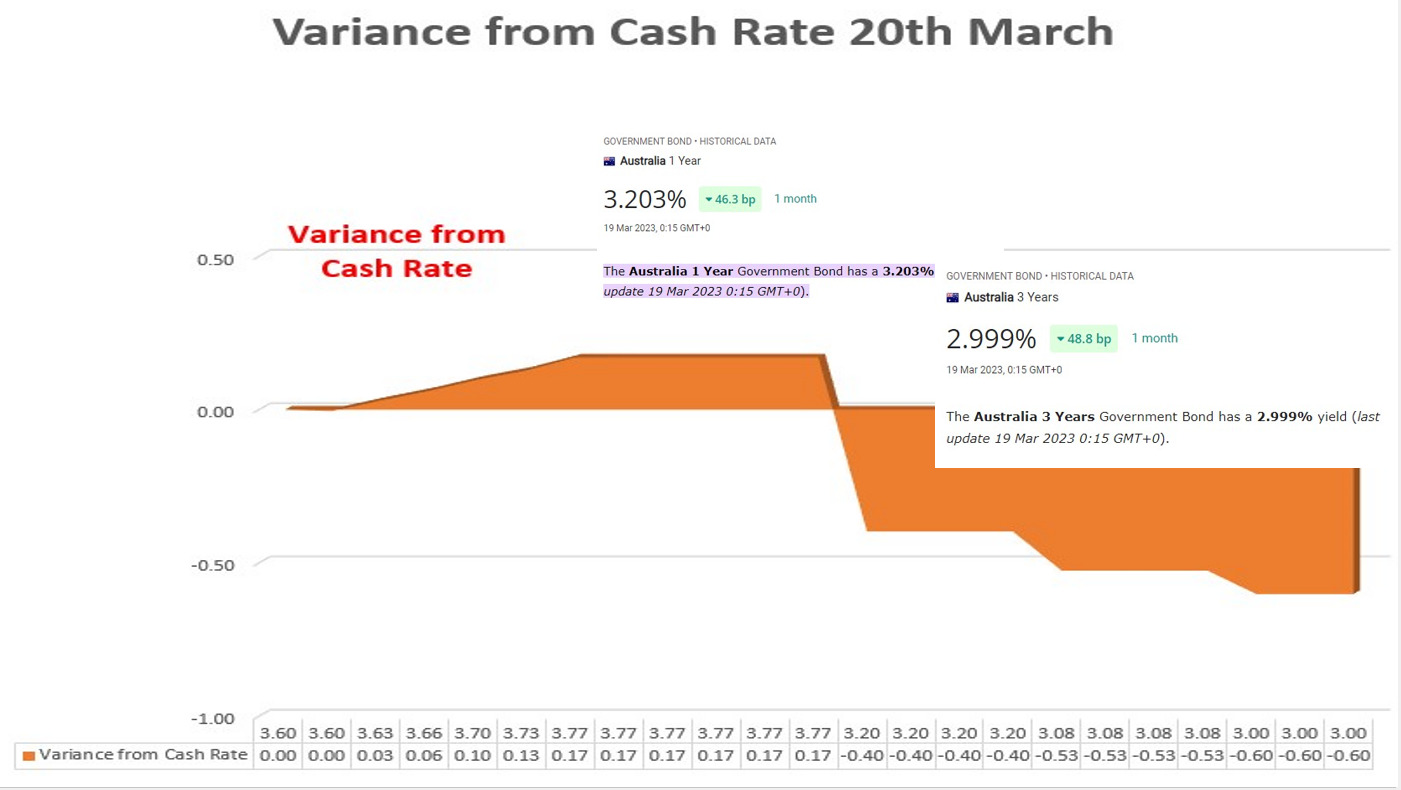

The bond market is currently reflecting growing concerns over the potential for bank failures, a looming recession, and increasing distrust between financial institutions, echoing the Global Financial Crisis (GFC) of 2008. The market has factored in a 0.50% rate drop in the next 12 months, indicating investors’ fears over the state of the economy.

One of the primary factors driving these concerns is the fear of bank failures. The financial sector has faced several scandals and regulatory fines in recent years, leading to a growing sense of distrust between institutions. This lack of trust has created an environment of risk aversion, with investors becoming increasingly cautious about lending money to banks and other financial institutions.

Moreover, many experts predict a looming recession, and this is contributing to the drop in bond yields as investors seek safe-haven assets to protect against potential losses. The fear of a recession is exacerbated by the ongoing COVID-19 pandemic, which has caused significant disruptions to the global economy.

Excessive government spending due to their COVID response and historically low rates has added to the high levels of inflation in the economy, making it difficult for central banks to find a clear course of action to address the issue.

Central banks are struggling to find the right approach to address these challenges. With inflation continuing to rise and fears of a global recession growing, there is no clear strategy for central banks to follow. This has created a sense of confusion and uncertainty, with many investors unsure of how to respond to the current economic climate.

Despite these challenges, it is essential to remember that the bond market remains a critical barometer of the global economic outlook. While the current trends may be concerning, they also reflect the cautious and measured approach that many investors are taking to the challenges that lie ahead.

As always, it is important to keep a close eye on developments in the bond market and the wider economy. By staying informed and aware of the latest trends and developments, investors can position themselves to weather any storms that may arise and make informed decisions about their investment strategies.

Doug Daniell – CEO Futurus -Guest Contributor