Domain Research| 23 June 2022

Domain Spotlight Report – New South Wales

It’s no secret that the NSW property market is the priciest in Australia, and Sydney competes on a global scale as one of the world’s most expensive cities in which to purchase a home. Though you’ll be hard-pressed to match the lifestyle and location on offer in Sydney and regional NSW with its appealing climate, renowned beaches and boundless natural beauty from the snowfields, to bush to surf as well as close proximity to key working hubs.

It’s no secret that the NSW property market is the priciest in Australia, and Sydney competes on a global scale as one of the world’s most expensive cities in which to purchase a home. Though you’ll be hard-pressed to match the lifestyle and location on offer in Sydney and regional NSW with its appealing climate, renowned beaches and boundless natural beauty from the snowfields, to bush to surf as well as close proximity to key working hubs.

As a leading property marketplace, Domain has a depth and breadth of insight in “real time” into the Australian property market. Through this unique combination of user engagement and property data, and a team of dedicated research experts, the Domain Spotlight Report aims to help inspire confidence in all of life’s property decisions, by shining a light on property trends across NSW.

The report dives into the various factors that influence the current NSW property landscape. We explore the state of play, breaking it down by area as we know no two are the same, analyse key property trends that are emerging and uncover the driving factors behind these changes.

Life in NSW

- NSW is Australia’s oldest state.¹

- NSW is Australia’s largest state economy, accounting for around a third of the nation’s economic output.²

- NSW is the most populous jurisdiction in Australia.³

- NSW is the most expensive state in which to purchase a house or unit in Australia.⁴

- The NSW border is the longest of all Australian state and territory borders, measuring a lengthy 4,625 kilometres.⁵

- It is renowned for some of the world’s most glorious beaches, however it has the shortest coastline of all Australian state and territory borders.⁶

- Sydney is among the largest and least densely populated cities in the world.⁷

- Sydney has the deepest natural harbour in the world with 504,000 megalitres of water.⁸

- The Sydney Harbour Bridge is the tallest steel arch bridge in the world and one of the longest.⁹

- Sydney is a multicultural city with 43% of the population born overseas compared to 33% of overall Australia.¹⁰

- The Snowy Mountains region is home to the tallest mountain range in Australia, providing some of the best nature-based activities and ski adventures that the country has to offer. It is mainland Australia’s only true alpine region.¹¹

The current state of the NSW property market

Placing a spotlight on property prices

Sydney is renowned for its roller-coaster property price cycles. These price cycles are not for the faint-hearted, a momentum that continually dips buyer sentiment in and out of the fear of missing out. And nothing beats the smouldering price growth seen in the most recent boom.

The peaks and troughs of Sydney’s house price cycle

In the scheme of Sydney upswings, the recent growth phase during 2020-22 was an unusual one compared to others in the past (figure 1). The upswing was a standout in terms of its speed and size, leaving the others firmly in the rear-view mirror. Sydney house prices rose 40% from the trough in June 2020 through to March 2022, providing the steepest upswing on record (note, prices wobbled during the onset of the pandemic from March to June 2020).

Let’s be clear: house prices rose 40% in under two years, a massive rise in a short period of time. That’s a daily increase of $708 throughout the pandemic. Technically, previous upswings have seen greater rates of house price growth over a longer period of time. However, the most recent one provided the quickest and sharpest equity boost Sydney has ever experienced – a golden era for homeowners.

Figure 1. The historic incline of Sydney house prices, trough to price peak¹²

Sydney’s housing market is now technically entering into a downturn with many market indicators weakening despite overall house prices nudging marginally higher during the first quarter of 2022. As per historical standards, the premium price-point is leading the price cycle direction as 6.5% was shaved from house prices over the first quarter of 2022. It’s clearly evident in the most expensive areas of Sydney with the median house price falling 8.5% in the Eastern Suburbs since its peak in June-2021, and it was the first Sydney region to hit a price peak (table 1). This has wiped $315,000 off of the median house price but this is nothing compared to the $927,000 gained in the 12 months leading up to its price peak.

Table 1. House price peaks across Sydney regions.¹³

| Region | Median house price | $ gain from Jun-20 to Mar-22 | Peak reached | $ lost since peak | % lost since peak |

| Baulkham Hills & Hawkesbury | $1,805,000 | $557,500 | At peak | $0 | 0% |

| Blacktown | $970,375 | $220,375 | At peak | $0 | 0% |

| Central Coast | $960,000 | $305,000 | At peak | $0 | 0% |

| City & Inner South | $1,920,000 | $438,000 | Dec-21 | -$40,000 | -2.0% |

| Eastern Suburbs | $3,410,000 | $612,000 | Jun-21 | -$315,000 | -8.5% |

| Inner South West | $1,410,000 | $360,000 | At peak | $0 | 0% |

| Inner West | $2,400,000 | $680,000 | At peak | $0 | 0% |

| North Sydney & Hornsby | $3,000,000 | $864,000 | At peak | $0 | 0% |

| Northern Beaches | $2,787,500 | $915,000 | Dec-21 | -$14,000 | -0.5% |

| Outer South West | $875,350 | $215,350 | At peak | $0 | 0% |

| Outer West & Blue Mountains | $895,000 | $226,500 | At peak | $0 | 0% |

| Parramatta | $1,155,000 | $266,500 | Dec-21 | -$50,500 | -4.2% |

| Ryde | $2,215,000 | $565,000 | Dec-21 | -$115,000 | -4.9% |

| South West | $1,033,750 | $283,750 | At peak | $0 | 0% |

| Sutherland | $1,625,000 | $445,000 | Dec-21 | -$95,000 | -5.5% |

So, what can we expect prices to do in the future?

Comparing an upswing and a subsequent downturn can reveal some interesting points:

- The duration that prices rise (the upswing) tends to be longer than the subsequent decline (the downturn). Downturns have often been less than half the duration of the preceding upswing.

- There is often a greater percentage increase in price relative to the subsequent decline so it is unlikely we will see a return to pre-pandemic prices.

- Historically downturns have been shorter and less severe compared to the preceding upswing.

The last significant downturn was during 2017-19 when Sydney house prices fell 13.8% from peak to trough (figure 2). Interest rates weren’t rising at the time but it became harder to get a loan and less credit was available for borrowers, plus throw in a banking royal commission to add to jitters.

This time, interest rates are rising, increasing the cost of a home loan and reducing borrowing capacity at a time when living costs are soaring. The speed and scale at which Sydney prices soften depend upon many factors, however the downturn will be largely shaped by how high and quickly interest rates go up, and how high inflation reaches.

Although interest rates are important, they are not the only factor influencing housing prices. Tax settings, banking regulation, population and income growth, and the responsiveness of new housing supply to growing demand all influence property prices. Property prices are partly driven by momentum, which means when prices fall this is likely to lead to further price falls – fear can feed fear, both positively and negatively.

- The current level of household debt makes Australian mortgage holders sensitive to higher interest rates that will squeeze household budgets.

- The higher level of debt means that the RBA won’t need to increase rates as much as it has in the past to cool inflation.

- Falling interest rates have been a key driver of rising house prices in Australia and across the world.¹⁴

- The RBA has found that a percentage-point cut in interest rates boosts dwelling prices by 8% after two years.¹⁵

Figure 2. The historic declines of Sydney house prices, price peak to trough

Taking a local look at NSW

The record-breaking upswing has been felt by a varied amount across the state. House prices across all Sydney suburbs experienced an increase in price over the past year, ranging from 6% to almost 58% (figure 3).¹⁶ This broad-based lift in price has been like a lottery win for some home owners in areas such as Terrigal on the Central Coast and Palm Beach on the Northern Beaches that saw prices rise by over 50% over the past 12 months alone.

Figure 3. Top suburbs for house price growth in Sydney¹⁷

Looking into Regional NSW, one suburb that has witnessed exponential growth was Mollymook Beach, on the NSW South Coast, up by 62% annually and 106% over the past five years. This is the strongest rate of annual house price growth across all Australian suburbs.

Australia’s highest-growth suburbs over the past year can be found in NSW: Byron Bay and Jindabyne units, and houses in Mollymook Beach.

Units in Byron Bay and Jindabyne struck the top two spots for the highest annual growth across Australian suburbs. This speaks to the demand and value of properties within close proximity to lifestyle factors, whether that be the ocean or snowfields. Or, affordability has contained budgets to units within these areas, or simply the rise of the holiday-home buyer.

| Highest-growth suburbs in Sydney.¹⁸ | Highest-growth suburbs in Regional NSW.¹⁹ |

| Barden Ridge, houses, 57.7%Terrigal, houses, 52.6%Palm Beach, houses, 50.2%Long Jetty, houses, 49.2%Allambie Heights, houses, 46.5%Ettalong Beach, houses, 43.3%Norwest, units, 43.1%Vaucluse, houses, 42.8%St Ives Chase, houses, 42.5%Umina Beach, houses, 42.1% | Byron Bay, units, 104.3%Jindabyne, units, 77.2%Mollymook Beach, houses, 62.4%Vincentia, houses, 56.6%Narrawallee, houses, 49.7%Bangalow, houses, 49.5%Lennox Head, 48.8%Burrill Lake, houses, 48.6%Suffolk Park, houses, 48.5%Gerringong, houses, 48.3% |

Million dollar club²⁰

- 62% of suburbs in Sydney have a median house price above $1 million compared to only 44% five years ago.

- 16% of suburbs in Regional NSW have a median house price above $1 million compared to only 1% five years ago.

- It’s pretty easy to find a million-dollar suburb in Sydney, with many regions having none below that price. Baulkham Hills and Hawkesbury, City and Inner South, Eastern Suburbs, Inner South West, Inner West, North Sydney and Hornsby, Northern Beaches, Ryde and Sutherland are areas where all suburbs have a median house price above $1 million.

- 31% of suburbs in Sydney have a median unit price above $1 million compared to only 6% in regional NSW.

- You’ll find the most million-dollar unit suburbs in the Northern Beaches with 79%, followed by Eastern Suburbs at 78% and North Sydney and Hornsby at 61%.

Percentage of suburbs that experienced price rises²¹

- 100% of Sydney suburbs saw house prices rise annually and 83% for units.

- 99% of Regional NSW suburbs saw house prices rise annually and 87% for units.

- Three-quarters of NSW suburbs saw house prices rise more than 20% over the past year, while for units it was roughly one-fifth of suburbs.

- The biggest winners in terms of capital growth for houses can be found on the Central Coast, with 96% of suburbs scoring above 20% annual house-price growth, followed by the Northern Beaches at 95%, Sydney’s South at 94% and Wollongong at 89%.

- The biggest winners of capital growth for units can be found in Regional NSW, with 63% of suburbs scoring above 20% annual unit price growth, followed by the Northern Beaches at 54% and Newcastle at 50%.

First-home-buyer opportunities²²

- 13% of suburbs have a median house price below the crucial $800,000 NSW First Home Buyer Assistance Scheme threshold, and 46% of suburbs for units are eligible for a full or partial exemption of stamp duty.

- First-home buyers are more likely to get a foot in the door in Regional NSW, with 65% of suburbs having a median house price below $800,000, and 91% of suburbs for units.

Prices rising faster than incomes²³

- 91% of suburbs in NSW saw house prices grow more than the annual household income.

- 33% of suburbs in NSW saw unit prices grow more than the annual household income.

Coastal suburbs are in hot demand

Sydney is renowned for some of the world’s most glorious beaches despite NSW having the shortest coastline out of all the states – a prestige that makes a beachside suburb highly sought after.

What areas are in greatest demand?

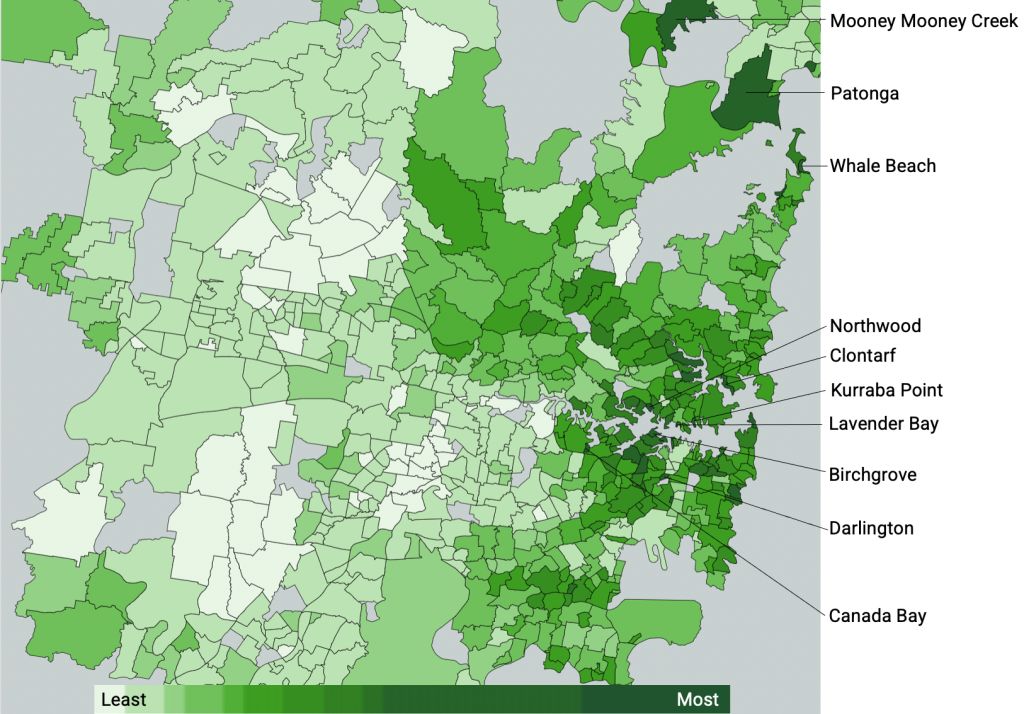

Ever wanted to know which areas are most in-demand to size up competition or decide if now is a good time to sell? By looking at the average number of views per property listing on Domain we can see what areas potential buyers are most interested in (figure 4).

The top 10 Sydney suburbs with the most views per listing are all in coastal pockets, bar one – the trendy inner-west suburb of Darlington. Northwood and Kurraba Point (on the Lower North Shore) and Whale Beach (on the Northern Beaches) take the top spots for the most in-demand suburbs. This data clearly speaks to the demand and value of properties within close proximity to the ocean, and the subsequent price tag they can fetch when boasting this alluring lifestyle factor. Northwood, Kurraba Point, Whale Beach, Birchgrove, Mooney Mooney Creek, Lavender Bay, Clontarf, Canada Bay, Patonga and Darlington are Sydney’s most desired spots.

Figure 4. The average views per listing by area across Sydney²⁵

Homes are selling fast, just not as fast

If there is one thing we know about Sydney’s property market it’s that homes were selling at lightning speed last year. There are countless reports of buyers missing out on a home within hours of it being listed for sale. This created frustrated buyers and further fuelled the fear of missing out. But is this still the case today?

2021’s speedy sales

In Sydney, the average time a house spent on the market dropped to 31 days in December 2021 – the quickest on record. At the same time, units were selling in 62 days on average – the quickest since 2018. This race for a house also occurred in Regional NSW, with the time a house spent on the market dropping to 55 days in January 2022, the quickest since 2004 (figure 5).²⁵ Last year was the first time since 2005 that houses in Regional NSW sold quicker than units in Sydney, this is still the case today. To put this in perspective, we tend to see quicker sales in Sydney compared to Regional NSW. Units in Regional NSW are continuing to see the days on the market drop, currently sitting near an all-time low of 50 days.

Figure 5. The average number of days to sell²⁶

Buyers can breathe a sigh of relief as these speedy days of transacting property are changing

The extra time a home is spending on the market compared to recent low:

- 8 days extra for Sydney houses

- 0 days extra for Sydney units

- 1 day extra for Regional NSW houses

Houses in Sydney are seeing the biggest increase in selling times

This speaks to the overall slowing momentum as the average time a property spends on the market draws out.

Table 2. Suburbs where homes are the quickest to sell²⁷

| Rank | Sydney | Regional NSW | ||

| Houses | Units | Houses | Units | |

| 1 | Killarney Heights | Fairlight | Russell Vale | Bellambi |

| 2 | Summer Hill | Manly Vale | Yanderra | Lake Illawarra |

| 3 | Dean Park | Brookvale | Hamilton North | The Hill |

| 4 | Lewisham | Waverton | Haywards Bay | Lennox Head |

| 5 | Narellan Vale | Menai | Mayfield East | Coniston |

How are people selling?

Across all states and territories, the dominant sales method is by private treaty. However, there has been a clear trend toward transacting a property by auction over the past 10 years as the proportion of sales by auction has almost doubled across Australia.²⁸ The uptake does vary between and within cities and is more prevalent for houses compared to units. Sydney is considered one of Australia’s most auction-centric cities, along with Melbourne and Canberra. Each year, they see a higher proportion of sales occur by auction than in other cities.

It has long been established that higher-priced homes tend to sell at auction compared to selling by private treaty.²⁹ The uptake of auctions varies vastly depending upon location, with inner-city locations leading the way. Traditionally, sales by auction were limited to premium, higher-priced suburbs, but this method of selling a home has cascaded to the middle and outer Sydney suburbs. Although, to this day, the more expensive areas of Sydney dominate, having the highest percentage of homes sold by auction (table 3). This is led by the Inner West with 61% of houses sold by auction, followed by the City and Inner South and Ryde, both of which have 59% of houses sold by auction.

Table 3. The proportion of sales by transaction method and median price³⁰

| Area | Houses | Units | ||||

| Proportion by auction | Median, auction | Median, private treaty | Proportion by auction | Median, auction | Median, private treaty | |

| Greater Sydney | 29% | $1,810,000 | $1,000,000 | 15% | $1,100,000 | $749,000 |

| Regional NSW | 9% | $940,000 | $625,000 | 5% | $808,000 | $540,000 |

| Central Coast | 11% | $1,235,000 | $852,150 | 2% | – | $590,000 |

| Baulkham Hills & Hawkesbury | 30% | $1,850,000 | $1,500,000 | 3% | – | $753,500 |

| Blacktown | 13% | $1,096,000 | $910,000 | 0% | – | $580,000 |

| City and Inner South | 59% | $1,900,000 | $1,825,000 | 20% | $980,000 | $920,000 |

| Eastern Suburbs | 54% | $3,499,000 | $3,400,000 | 36% | $1,307,000 | $1,330,000 |

| Inner South West | 47% | $1,420,000 | $1,265,000 | 8% | $762,500 | $639,975 |

| Inner West | 61% | $2,320,000 | $2,100,000 | 15% | $900,500 | $795,000 |

| North Sydney & Hornsby | 54% | $2,880,000 | $2,600,000 | 28% | $1,150,000 | $890,000 |

| Northern Beaches | 46% | $2,715,000 | $2,700,000 | 31% | $1,338,000 | $1,140,000 |

| Outer South West | 4% | $904,250 | $810,000 | 1% | – | $525,000 |

| Outer West & Blue Mountains | 4% | $920,000 | $835,600 | 0% | – | $520,000 |

| Parramatta | 36% | $1,271,000 | $1,020,000 | 4% | $671,000 | $612,000 |

| Ryde | 59% | $2,300,000 | $2,100,000 | 8% | $833,000 | $790,000 |

| South West | 20% | $1,017,000 | $907,000 | 2% | – | $515,000 |

| Sutherland | 43% | $1,720,000 | $1,540,000 | 7% | $980,000 | $781,550 |

Why have auctions grown in popularity?

- Auctions offer greater transparency for buyers and sellers alike, allowing the depth of competition to be seen and full disclosure of the price the market is willing to pay for the home.

- Putting a property under the hammer is an efficiently fast method of sale, supported by an intense marketing campaign that typically lasts three to four weeks.

- The seller’s nerves are protected by a reserve price.

- They provide an unconditional sale. Once the hammer falls the property is legally sold.

- If the property passes in, they provide an easy opportunity for negotiation with interested parties.

- Often an early sale can occur, prior to auction day. This can increase during an upswing and downturn for differing reasons.

- For buyers, auction negotiations are open for all attendees to see.

Supply swinging to buyers

Market conditions are shifting and supply is at the centre of this change. The supply of properties for sale is building and swinging power back towards buyers. This has created better purchasing conditions, providing home hunters time to contemplate rather than compromise, and ultimately allowing rational decisions to be made.

A fundamental driver of the Sydney and Regional NSW upswing was a lack of supply at a time of strong demand, resulting in the overall choice of homes for sale hitting a multi-year low (figure 6).

- Availability of houses for sale in Sydney hit a multi-year low in January 2021.

- Availability of houses and units for sale in Regional NSW hit a multi-year low in January 2022.

Figure 6. The total supply of residential properties for sale³¹

The supply-demand dynamics have been shifting in 2022. It is clear sellers have become motivated and are strategically timing a sale while prices are close to a peak and prior to a further tightening rate cycle that will further impact borrowing capacity and the cost of a mortgage. At the same time, affordability is already having an impact on upgraders and first-home buyers as the value of home loans ease. This changing balance is slowly rippling across Sydney, sellers are having to be more realistic with pricing, and cautious buyers are armed with greater choice.

Buyers are getting back into the driver’s seat

The number of homes for sale continues to build and buyers will find the choice of houses on the market in Sydney is up by 8% compared to last year and 10% for units. It remains more challenging for buyers in Regional NSW with the total number of houses for sale 1% higher compared to last year and 13% lower for units.

Table 4. Areas with the biggest jump in property listings³²

| Sydney | Regional NSW |

| Blacktown – North | Maitland |

| Rouse Hill – McGraths Hill | Lower Murray |

| Mount Druitt | Richmond Valley – Coastal |

| Blacktown | Kiama – Shellharbour |

| Bringelly – Green Valley | Coffs Harbour |

Who is driving demand in NSW?

Home-loan data shows a change in buyer type

Home-loan data allows us to identify who is buying and therefore driving demand for property. Figure 7 shows that at the beginning of the pandemic we saw a dip in the value of home-loan financing across all buyer types as the national lockdown hindered transactional activity. This dip was short-lived and the bounce-back was swift across all buyer types, spiralling to a record high.

Figure 7. The value of NSW home loans by buyer type³³

2022 has shown some interesting changing trends across the different buyer segments and who is driving demand.

Owner-occupier loans skyrocketed 101% from May 2020 to the peak in July 2021 (seasonally adjusted value of home loans). While this buyer group remains the driving force of demand across NSW it has dropped by 23% from the high. Despite the prospect of fetching a strong price for their current home, it is the associated costs of moving (such as stamp duty and legal fees), higher interest rates and the affordability of upgrading to a larger home (or perhaps superior location) that have become a greater financial hurdle. As the costs of living escalate, wages growth remains stagnant and interest rates rise, housing credit growth from upsizers is likely to continue to slow.

Owner-occupier first-home buyers are much more sensitive to changes in affordability and therefore it is not a surprise that the value of home loans financed has plummeted 37% from the May 2021 peak. It is a financial hurdle to save a lump-sum deposit, and prospective first-home buyers are finding this challenging amid rising living costs, low wage growth, weak saving rates, and the rapid rise in property prices seen in recent years.

Investors are the ones to watch as they are the buyer group that had been on the rise. The value of home loans to investors hit a record high in January 2022, and while it has dropped almost 10% in recent months from the peak, it remains close to a record high. Investors are reacting to a tight rental market and improved buying conditions. Strong rental prices and easing purchasing prices will help to improve gross rental yields. Although investor home loans are close to a record value, as a share of buyer activity they are back to similar levels seen in 2018.

International draw but internal city drain

Australia is a nation built on a foundation of migration, a strong population growth being drawn from natural increase and overseas migration. NSW has benefited from being an international hotspot, historically welcoming more new overseas residents than any other state or territory, along with Victoria. The pandemic created a significant shift in international population flows, as more people left Australia than arrived for the first time since 1946.³⁴ This had a disproportionate effect on Sydney and placed another aspect of population growth in the spotlight – interstate migration (figure 8).

Figure 8. NSW population drivers³⁵

There’s always been a net negative flow of residents away from NSW to other states and territories, meaning more people leave than arrive. This trend gained pace during the pandemic. A detailed look between Sydney and Regional NSW shows opposite interstate population movements, as interstate movements are positive in Regional NSW but a drain in Sydney.

Sydneysiders have always placed Regional NSW in their sights – it’s half the price of buying in Sydney. However, escalating internal migration, as a result of altered working patterns from all life stages, has brought to fruition a lifestyle that was considered a dream for some.

33% of total inquiries on Domain to Regional NSW have been from Sydney³⁶

While the flexible life is beneficial for some, it does prove a classist opportunity: three in five high-wage workers have the opportunity to work from home whereas fewer than one in five low-wage workers have the same flexibility.³⁷ This sparked heightened demand in Regional NSW, in lifestyle locations and within an extended commutable distance from Sydney and other major working hubs.

- Byron was the best performing LGA across Australia with house prices up 89% since March 2020.³⁸

- Snowy Monaro Regional was the second-best performing LGA across Australia with house prices up 86% since March 2020.³⁹

- Kiama house prices have risen 80% since March 2020, Australia’s fourth-highest growth LGA.⁴⁰

Gen Z sets sights on Sydney

Young people tend to migrate away from regional areas to capital cities, for career opportunities and higher education, access to more infrastructure and services, and to make the most of the nightlife and hospitality that comes with an urban lifestyle. This trend is perfectly mirrored in Sydney and Regional NSW. Generation Z is the biggest net drain from Regional NSW but is more favourable for Sydney.

Gen X and Millenials seek regional living

- Relocation into Regional NSW is led by Gen X followed by Millennials and Boomers.

- Collectively, people in the prime of their working years (25-44 years) with families in tow (0-14 years) are the biggest interstate group moving to Regional NSW for affordability, a laid-back lifestyle and more space.

- The biggest drain away from Sydney is led by Gen X followed by Millenials.

Lifestyle and space are on everyone’s mind

What are we looking for in a home?

Keyword searches on Domain shine a new light on specific attributes or features that prospective home hunters are looking for. It helps us to distinguish between changing trends or fleeting moments of desirability.

Australian homebuyers are largely driven by lifestyle and nothing showcases this more than keyword searches. NSW buyers are wanting so much more from their homes – waterfront suburbs and the added lifestyle luxury of a swimming pool.

Housing preferences initially triggered through pandemic lockdowns remain a firm favourite also – outdoor space, lifestyle additions and, of course, a study (table 5).

A home office remains a priority for Sydney buyers as knowledge-based employees work from home or opt for a hybrid approach. This segregated, dedicated working area is not as high on the wish list for regional NSW home-hunters, perhaps a reflection of the relative space premium in Sydney.

Rising through the keyword ranks has been the added extra of a granny flat (table 6). There are a plethora of benefits from this extra space, providing the ability to convert to a dedicated working space separated from the home, the option to have an older generation stay long-term, or the potential for extra income. It’s understandable why searching for a “granny flat” has become more common across NSW.

While Sydney and Regional NSW property markets are all unique, there are a few things they have in common and that is to do with what buyers are looking for in a home: property type and location. All emphasise the priority that NSW buyers place on lifestyle.

Table 5. The most searched keywords in 2022⁴¹

| Rank | Greater Sydney | Regional NSW |

| 1 | Pool | Pool |

| 2 | Study | Waterfront |

| 3 | Granny Flat (Granny) | View |

| 4 | Balcony | Beach |

| 5 | Waterfront | River |

| 6 | View | Water |

| 7 | Courtyard | Water View |

| 8 | Garden | Granny Flat (Granny) |

| 9 | New | New |

| 10 | Duplex | Dual |

- Location is top of mind as “waterfront”, “view”, “river” and “beach” all rank in the top keyword searches on Domain in NSW.

- The need for outdoor space continues to shape the NSW home with a “garden”, “courtyard” and “balcony” high on a Sydney buyer’s wish list. Outdoor space does not feature in the top 10 for regional NSW buyers.

- The importance of a dedicated workspace is a priority, with the search for “study” the second most used keyword in Sydney.

- In Regional NSW, the central point of the top 10 keywords are location or the type of property (new or dual), revealing the priorities for buyers.

- In Sydney, the top 10 are a combination of location, outdoor space, lifestyle features, the type of home and affordability.

The pandemic has been far too longstanding not to have a permanent impact on consumer behaviour. It’s forced us to adopt change and nothing shows this more than consumer behaviour when searching for property. The way we use our homes has altered since the pandemic, and perhaps forever made a mark on our purchasing decisions and property wish lists. There’s been a significant change in what people want in an NSW property since the onset of the global pandemic, as the way we use our homes has changed, making a mark on our purchasing decisions and property wish lists.

Table 6. The biggest changes in keywords⁴²

| Rank | Greater Sydney | Regional NSW | ||

| 2022 v 2021 | 2022 v 2020 | 2022 v 2021 | 2022 v 2020 | |

| 1 | Granny Flat (Granny) | Pool | New | View |

| 2 | Study | Study | Dual | Dual |

| 3 | Gas | Balcony | North | New |

| 4 | Warehouse | Courtyard | Access | Pool |

| 5 | Level | View | Shed | Lake |

Affordability is playing a greater role in home searches

The keywords “duplex” and “dual” scored a seat in the top 10 most used keywords in 2022. This suggests that rapidly rising house prices have perhaps constrained buyer budgets. It places the missing middle of affordable housing in the spotlight; those priced out of purchasing a house are now looking for an affordable alternative such as a split block.

It’s not surprising that the demand for affordable medium-density housing has risen (this includes townhouses, terraces, semi-detached, duplexes and dual occupancies). Evidenced in the rise of keyword searches on Domain for dual and duplex blocks.

Medium-density housing (such as townhouses, terraces and, semi-detached) is 31% cheaper than a house.⁴³ The main reason is the efficient use of land utilising common walls, smaller setbacks and common driveways. They are also smaller – 80% of medium-density homes had two or three bedrooms, compared to 39% of detached houses.⁴⁴

Most wanted property⁴⁵

| Sydney | Regional NSW | |

| House | 4 bed, 2 bath, 2 park | 4 bed, 2 bath, 2 park |

| Townhouse | 3 bed, 2 bath, 2 park | 2 bed, 1 bath, 1 park |

| Unit | 2 bed, 1 bath, 1 park | 2 bed, 1 bath, 1 park |

Most bought property type⁴⁶

- Sydney: House 52%; townhouse 7%; unit 42%

- Regional NSW: House 79%; townhouse 6%; unit 15%

Regional NSW houses boast the biggest block size at 891 square metres, that’s almost enough room for 25 average-sized backyard pools.⁴⁷

Block sizes trump in New England and North West, Southern Highlands and Shoalhaven, Murray and Coffs Harbour-Grafton, at over 1000 square metres, that’s enough room for roughly four full-sized tennis courts.⁴⁸

Houses remain the heavily favoured property type in Regional NSW, a trend that really speaks to the lifestyles and priorities of buyers. While houses are the preferred property type in Sydney by a small margin, there’s a more even split of sales between houses and units. This more even sales ratio between houses to units ratio can be pinned to the affordability issues of living in a pricey city.

There are crystal-clear differences between Sydney and Regional NSW buyer preferences. With more people making the regional move it has refocused people’s attention on what is around them, encouraging buyers to focus on the neighbourhood and surrounding area they are buying into and providing more opportunities to explore opportunities, such as residing close to a beach or river, that offer an appealing lifestyle.

Table 7. Suburbs with the most sales⁴⁹

| Rank | Sydney | Regional NSW | ||

| Houses | Units | Houses | Units | |

| 1 | Blacktown | Liverpool | Port Macquarie | Wollongong |

| 2 | Castle Hill | Cronulla | Orange | Newcastle |

| 3 | Baulkham Hills | Dee Why | Dubbo | Port Macquarie |

| 4 | Quakers Hill | Parramatta | Armidale | Tweed Heads |

| 5 | Oran Park | Sydney | Goulburn | Nelson Bay |

What a change in government means for the property market

Housing affordability and ownership are increasingly important issues for governments to address after record house prices pushed the idea of owning property out of the reach of many first-home buyers on low- to mid-level incomes. While prices are expected to fall this year, many buyers will still find the prospect of owning a home difficult. The federal government’s Help to Buy (HTB) scheme aims to assist first-home buyers with both the deposit and mortgage repayments, propelling buyers into the property market earlier and helping those who may not be able to buy otherwise.

Key facts: Help to Buy scheme⁵⁰

- Government helps with up to 40% of the purchase price of a new home and up to 30% for an existing home.

- Individual applicants must earn $90,000 or less or $120,000 for couples.

- Caps on property price vary from $600,000 to $950,000 depending on NSW location.

- Have a minimum 2% deposit.

- 10,000 available spots from July 2022.

- Must be a first-time home owner and live on the property.

Only 6% of first-home buyers will be helped each year⁵¹

As time goes on, the government will have an increasing stake in the property market and benefit from capital growth once the property is sold. However, the home buyer can purchase back stakes when they become more financially sound, at a 5% minimum. If the home owners’ annual income exceeds the earning caps for two years in a row, they will be required to buy back the government’s stake in the property in part or whole.

The Coalition also introduced the First Home Loan Deposit (FHLD) scheme to address affordability and home ownership constraints. First-home buyers can purchase a home with a 5% deposit (or 2% for single parents) with the government acting as a guarantor for the remaining so buyers can avoid paying Lender’s Mortgage Insurance (LMI). There are similar minimum requirements set out in order to qualify for the scheme, including income limits and deposit requirements, and the home must be your place of residence.

The major advantage of the HTB and the FHLD schemes are the significant differences in the time it takes to save for a deposit but the HTB scheme also assists in reducing mortgage serviceability. We’ve calculated the time it takes to save a deposit based on the best scenario, a buyer at the upper limit of the income threshold (table 6).

Table 8. Time to save a deposit for an entry-level home⁵²

An individual on $90,000

| Sydney | Regional NSW | |||

| Houses | Units | Houses | Units | |

| 2% (HTB) | 1y 3m | 10m | 8m | 6m |

| 5% (FHLD) | 2y 10m | 2y 1m | 1y 9m | 1y 4m |

| 20% | 12y 8m | 8y 5m | 7y | 5y 6m |

| HTB allows market access sooner by | 11y 5m | 7y 7m | 6y 4m | 5y |

A couple on $120,000

| Sydney | Regional NSW | |||

| Houses | Units | Houses | Units | |

| 2% (HTB) | 10m | 7m | 5m | 4m |

| 5% (FHLD) | 1y 11m | 1y 5m | 1y 2m | 11m |

| 20% | 8y 11m | 5y 11m | 4y 11m | 3y 10m |

| HTB allows market access sooner by | 8y 1m | 5y 4m | 4y 6m | 3y 6m |

Another selling point of the HTB scheme: you’ll need a smaller home loan as the government funds part of the purchase, therefore reducing home loan repayments (table 7).

Table 9. The proportion of income needed to cover home loan repayments for an entry-level home⁵³

An individual on $90,000

| Sydney | Regional NSW | |||

| Houses | Units | Houses | Units | |

| With HTB(plus 2% deposit) | 48.7% | 32.3% | 26.9% | 21.2% |

| Without HTB(plus 20% deposit) | 57.2% | 38% | 31.6% | 24.9% |

A couple on $120,000

| Sydney | Regional NSW | |||

| Houses | Units | Houses | Units | |

| With HTB(plus 2% deposit) | 34.2% | 22.7% | 18.9% | 14.9% |

| Without HTB(plus 20% deposit) | 40.2% | 26.7% | 22.2% | 17.5% |

It is recommended that home owners dedicate less than 30% of their income towards mortgage repayments to avoid “mortgage stress”. The HTB scheme dramatically reduces the proportion of income needed to cover home-loan repayments but still remains in mortgage stress.

More suburbs are in reach

A wider range of suburbs are made accessible to first-home buyers with the HTB scheme as the government equity stake boosts their purchasing power (table 10 & 11).⁵⁴

Table 10. The proportion of suburbs that have an entry-level price within reach of borrowing capacity, comparing HTB and FHLD schemes⁵⁵

| Individual on $90k | Couple on 120k | |||

| Sydney | Sydney | |||

| Houses | Units | Houses | Units | |

| FHLD Scheme | 15% | 55% | 31% | 72% |

| HTB Scheme | 47% | 88% | 47% | 88% |

Table 11. The proportion of Sydney suburbs that fall below the $950,000 HTB property price cap⁵⁶

| Houses | Units | |

| Entry price | 47% | 88% |

| Median price | 33% | 65% |

The financial burden of stamp duty

Prices growing faster than wages

Over the past 20 years, the average annualised growth of Sydney house prices is 7.3% and for Regional NSW 7.8%, whereas annualised wage price growth is less than half at 3.4%.⁵⁷ This level of price escalation is no easy feat for wage growth to contend with.

Stamp duty has risen even faster

Over the same period, median Sydney house prices and corresponding stamp duty have soared. Since 2002 Sydney house prices have risen 280% while the cost of stamp duty has escalated 406% (figure 9).

Figure 9. Sydney median house price, corresponding stamp duty and NSW average wage, index to 1995⁵⁸

Shifting from stamp duty to a property tax could improve housing affordability by reducing the upfront costs of buying a property. Stamp duty can prohibit people from moving homes to suit their needs with the belief that they need to stay in the property for a period to “claw back” the cost of stamp duty.

It could take years to accrue the same amount of property tax compared to the upfront cost of stamp duty.

Table 12: Stamp duty costs compared to the number of years it would take to accrue the same in property tax for a first home buyer⁵⁹

| Property purchase price | Stamp duty | Time it takes to equal in Property Tax (years) |

| $800,000 | $31,305 | 15 |

| $1,000,000 | $40,305 | 16 |

| $1,200,000 | $50,875 | 17 |

| $1,400,000 | $61,875 | 18 |

| $1,500,000 | $67,375 | 18 |

Summary

It’s been a golden era for NSW homeowners after an eye-watering upswing provided the quickest and sharpest equity boost for houses.

This has put home ownership further out of reach for many, widening the wealth divide between home owners and non-home owners, and stretching the ability of others to upsize.

- Sydney house prices rose 40% from the trough in June 2020 through to March 2022 – the quickest and sharpest equity boost on record.

- Housing preferences initially triggered through pandemic lockdowns remain a firm favourite also – outdoor space, lifestyle additions and, of course, a study. Rising through the keyword ranks has been the added extra of a granny flat.

- House prices across all Sydney suburbs experienced an increase in price over the past year, ranging from 6% to almost 58%

Market conditions are shifting and supply is at the centre of this change.

Sellers have been strategic with their market timing, listing homes for sale while prices remain close to a peak and before additional interest rates rises further puts a sting in borrowing capacity and mortgage affordability. This is encouraging if you are looking to buy as it means there is greater choice and the pleasure of taking a little time. We are expecting the slowdown in price growth to continue and purchasing conditions to improve for buyers.

- Annually, houses listed for sale in Sydney are up by 8% and up 10% for units. It remains more challenging for buyers in Regional NSW with the total number of houses for sale 1% higher compared to last year and 13% lower for units.

- Houses in Sydney are seeing the biggest increase in selling times. This speaks to the overall slowing momentum as the average time a property spends on the market draws out.

- The most expensive areas of Sydney have seen the biggest price drops; the Eastern Suburbs has had $315,000 wiped off its median house price since its peak in June 2021.

- Historically, downturns have been shorter and less severe compared to the preceding upswing. It is unlikely we will see a return to pre-pandemic prices.

Although interest rates are important, they are not the only factor influencing housing prices.

Tax settings, banking regulation, population and income growth, and the responsiveness of new housing supply to growing demand all influence property prices. Property prices are partly driven by momentum, which means when prices fall this is likely to lead to further price falls – fear can feed fear, both positively and negatively.

- The current level of household debt makes Australian mortgage holders sensitive to higher interest rates that will squeeze household budgets.

- The higher level of debt means that the RBA won’t need to increase rates as much as it has in the past to cool inflation.

Spiralling construction costs will make housing more expensive in the long term.

Escalating inflation and the shortage of building supplies are blowing out the costs of building a new home or renovating one and increasing the replacement cost of a home. Long term, this could feed into higher housing prices.

- Cost of house construction has risen 15.4% annually due to increased material prices and supply chain disruptions.⁶⁰

Looking forward, net overseas migration remains essential for long-run population growth and is likely to be a government focus.

The foundational logic is that creating a “Big Australia” through a big population is a way to sustain higher economic growth and build Australia’s skilled workforce. A targeted approach to migration will be one lever to plug the gap of skills shortages, which will add to the demand for housing.