The Economist | 31 August 2013

America surges, much of Europe sinks

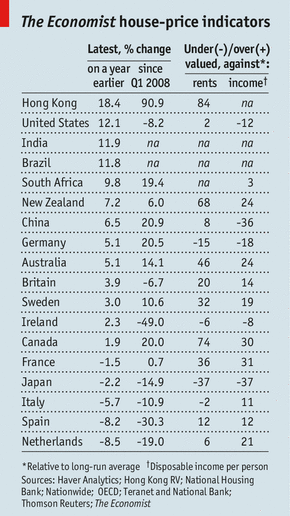

HOUSING markets are prone to boom-and-bust cycles, with prices overshooting then undershooting sustainable levels. To work out whether they are over- or undervalued, The Economist uses two gauges. One assesses affordability by comparing prices with disposable income. The other considers the case for investing in housing by comparing prices with rents. If these ratios are higher than their historical averages (since the mid-1970s) property is overvalued; if they are lower it is undervalued. On this basis, Canada’s house prices are bubbly whereas Japan’s are undeservedly flat (see table).

America’s formerly stricken market has rebounded: house prices have risen by 12.1% over the past year. But the recovery still appears to be sound, since prices remain undervalued against income. A sharp rise in mortgage rates since May, on signs that the Federal Reserve will shortly slow the pace of asset purchases, may in any case temper the boom.

Despite favourable valuations, Japanese house prices continue to fall, though at a modest 2.2%. The worst-performing markets are in the euro area, notably in southern Europe (Spanish prices are down by 8.2% in the past year) but also in some northern countries (Dutch prices have fallen by 8.5%). The French market is also depressed. Valuations remain stretched in Spain even though house prices have fallen by 30% since early 2008. But the recent pick-up in the Irish market looks sustainable following a 49% price crash.

Brighter signs gleam elsewhere, especially in Germany, which avoided the pre-crisis frenzy. Prices there have risen in the past year by 5.1%, which should bolster domestic demand and help support the economic recovery in the euro zone.

{rokcomments}

Recent Comments