Pete Wargent| Livewrie| 28 June 2022

What a 3.2% cash rate will mean for property prices and household savings – Pete Wargent | Livewire (livewiremarkets.com)

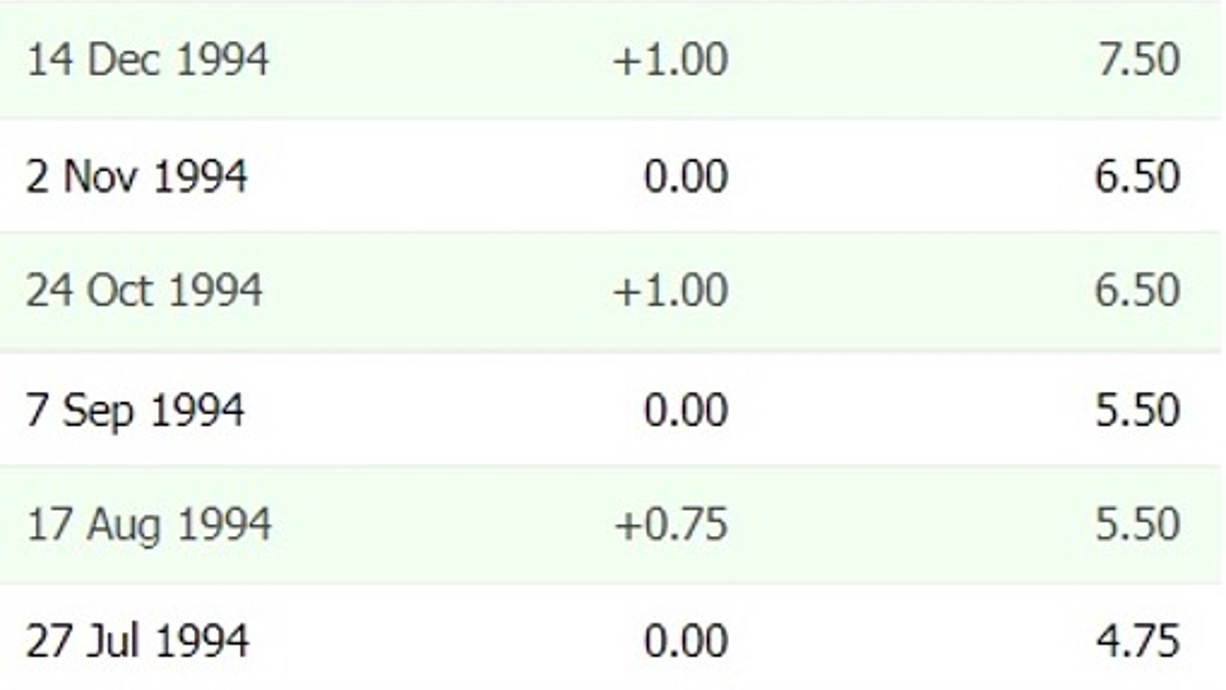

At the time of writing, market pricing is looking for the cash rate to reach 3.20% by the end of 2022, which would be an even faster-tightening cycle than that seen in the second half of 1994, if it transpires.

In 1994, Australia experienced a rapid-fire 275 basis points of hikes between August and December.

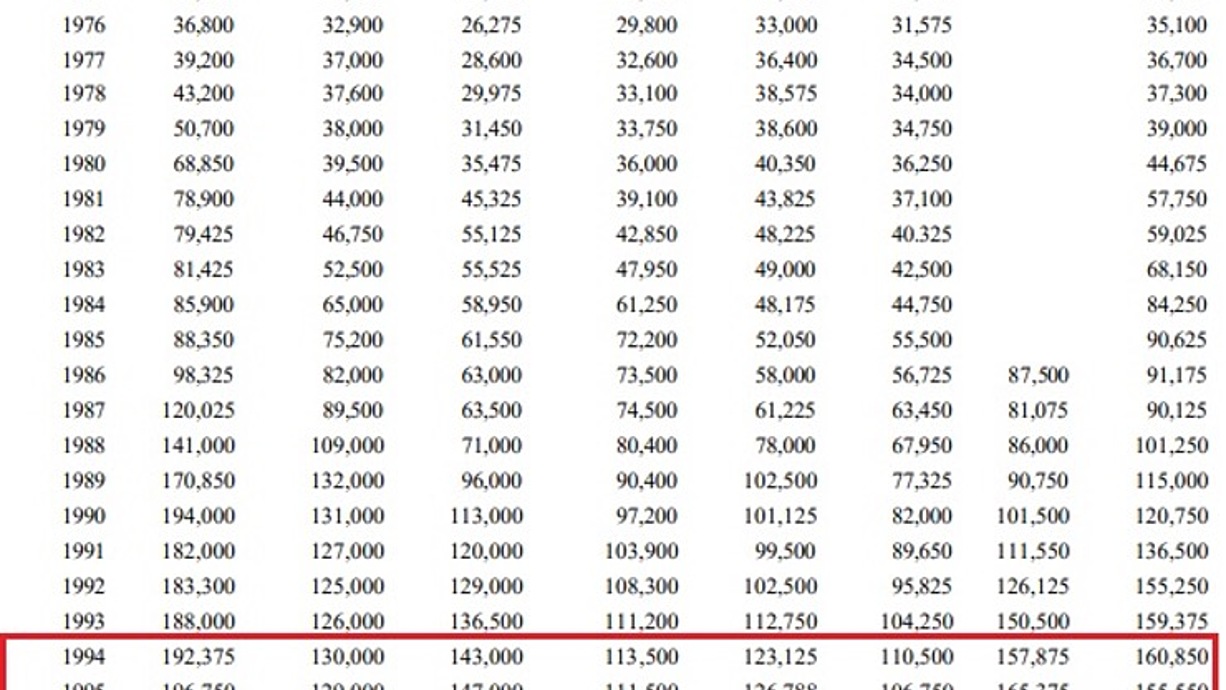

For some historical context, this record pace of tightening tripped a modest nominal housing price downturn in four of Australia’s eight capital cities, namely Melbourne, Adelaide, Canberra, and Hobart (Sydney and Perth had already experienced a downturn in the 1991 recession).

Fast-forwarding to today, if the cash rate were to rise above 3% in such a short space of time the impact on household cashflows in 2022/3 would be swift and pronounced, especially in an environment where food, fuel, and energy prices have been rising so sharply.

Meanwhile, the trend in asking rents suggests that renting households will also see a jump in rental costs over the coming year.

While it’s not possible to predict the trajectory of the cash rate accurately, it looks increasingly likely that both headline and underlying inflation in Australia won’t peak until the fourth quarter of the calendar year 2022, perhaps at somewhere in the range of 6-7% for headline inflation, and 4.5-5% for core inflation.

In the short term, subsidies in the form of state electricity credits could take some of the edge off the predicted huge surge in energy and electricity costs, but there is plenty still to flow through to the official CPI figures yet.

Since inflation is still reported quarterly and with a lag in Australia, it seems logical to expect that there will be monetary tightening as late as February 2023 in response to the cycle highs for inflation.

From this point, it looks likely that the annual inflation rate will then begin to fall in 2023 – in which case the terminal rate may not be quite as high as presently implied by financial markets.

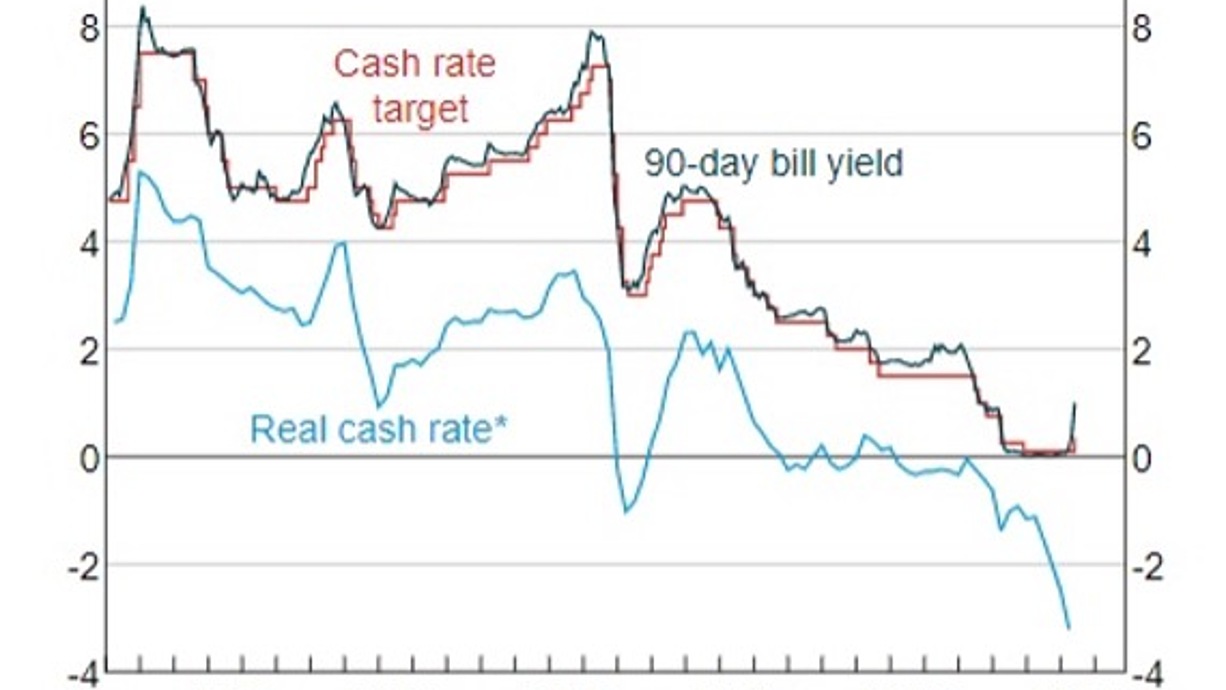

At the time of writing, financial markets are pricing for a cash rate moving to as high as 3.75% in 2023, but commodity prices are now falling, and if supply chains normalise then a terminal cash rate target of nearer 2.5% seems like a more likely scenario at this point in time.

Of course, much can change very quickly at the moment, and predicting the future in such an environment can be something of a fool’s errand.

If pressed to make a prediction, we might expect a salvo of two further 50 basis points hikes which would see consumer sentiment take a further significant knock – and then a further two 25 basis points hikes by February 2023, would get us to a cash rate target of 2.35%, with some obvious upside risk to that figure according to market pricing.

With so many borrowers having never experienced a meaningful increase in mortgage rates, the impact on sentiment may be more significant than the impact on cashflows over the coming 9 months.

The situation remains fluid, so let’s revisit this in February and see how things play out!

Refinancing options remain open

Fixed mortgage rates on offer from lenders have inevitably soared in response to funding market dynamics.

Following a record surge in borrowers fixing their mortgage rates through the pandemic – at the 2021 peak brokers were reporting almost 40% of loans being written on fixed-rate terms – understandably relatively far fewer borrowers are now taking fixed rate offerings.

Towards the end of 2023, fixed-rate borrowers will get something of a shock when fixed-rate mortgages written at around 2% begin to expire, being the so-termed ‘fixed rate cliff’. Known risks such as this which are flagged so far in advance rarely prove to pack the feared punch.

On the positive side of the ledger for borrowers, variable rate mortgage offerings remain sharp across the board for the time being, at around 3% (or in some cases lower for principal and interest homebuyer mortgages).

And unlike during the credit squeeze accentuated by the Royal Commission, credit is flowing reasonably smoothly, with most prospective borrowers able to find loans either with a bank or a non-bank lender.

Of course, variable rate borrowers today need to factor in that mortgage rates are likely to rise sharply at least over the next 9 months, and possibly longer.

Asset values in decline

Housing market modelling can be phenomenally complex at the SA4 regional level, or relatively simple at the macro level.

An increase in the cash rate target from the zero lower bound to around 2.5% would have a very noticeable impact on both consumer and housing market sentiment, as well as on borrowing capacity for property buyers (naturally if the cash rate went higher then the impact would be correspondingly more pronounced).

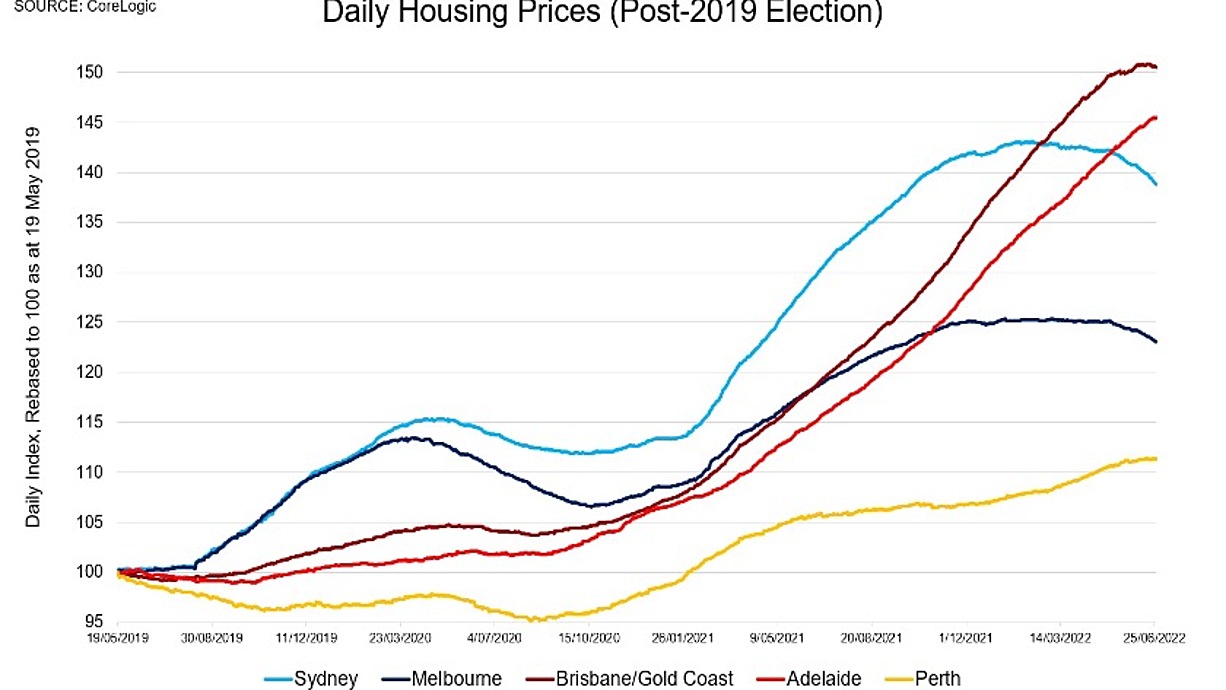

As such, a property market downturn has already been underway since February/March in Sydney and Melbourne, with other markets also gradually losing momentum.

Stock listing levels remain relatively tight, however, especially in Brisbane, Adelaide, and much of regional Australia.

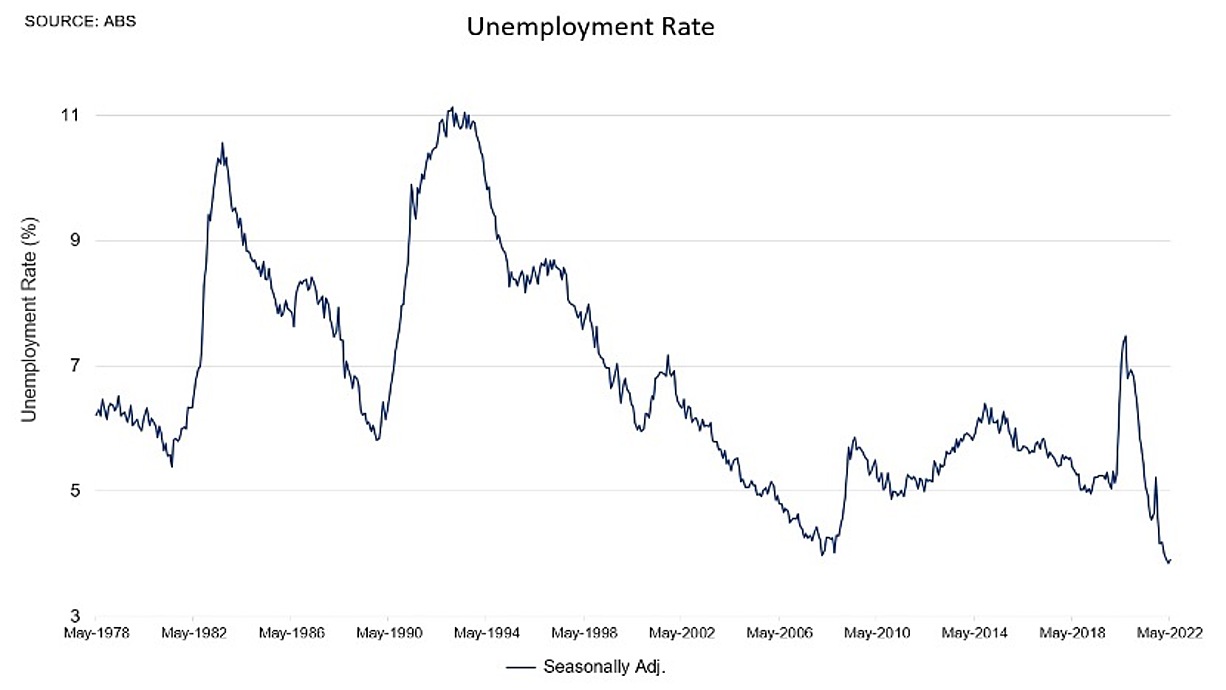

And there will be few forced sellers with employment at a record high of above 13.5 million and the unemployment rate at near half-century lows at under 4%.

It is worth noting that housing market modelling is often based upon changes in real interest rates, and the real cash rate remains deeply in negative territory at this stage.

It’s also worth noting that interest rates now rising reflects that we’ve also experienced a dramatic rebound in hiring, construction costs, household incomes, asking rents, and population growth.

Given the absolute level of interest rates remains historically low, the downturn in housing market sentiment will most likely last for as long as consumers fear rising interest rates, which points to the end of Q2 2023 as a potential nadir for the cycle.

At the current rate of decline, the implied peak-to-trough decline might be one of up to 15% for Sydney, and potentially more at the premium end of the market, which tends to be ‘thinner’ or more illiquid.

Brisbane, Adelaide, and Perth have all recorded quarterly price growth to date, so there’s been no meaningful downturn in prices to speak of so far, although momentum is slowing.

Nationally, rental vacancies are already at 16-year lows of just 1% and given that the borders are now reopening in earnest the busy summer months could see some significant pressure on the availability of accommodation, with permanent migrants and visitors preferring to arrive in the warmer season.

As a national network of buyer’s agents, we experienced a drop-off in enquiries from the early part of 2022, and some homebuyers actually put their searches on hold in April and May.

However, there has been an uptick in investor enquiry lately, and with rental price growth expected to rise to an annual pace of almost 20%, more investors are now turning back to the property as a potential inflation hedge.

Soft landing: modest negative impact from the wealth effect

Consumer confidence in New Zealand has already hit the lowest level on record, and in Australia consumer confidence is close to the levels hit in the early 1990s recession – and this is before Australia’s cash rate target has even increased to above 1%.

At no point over the past three decades has a tightening cycle got underway when confidence levels were at such low levels, so history may not be the best guide.

Of course, sentiment is low partly in anticipating of the potential quantum and trajectory of rate hikes, but this is one the key arguments for why the cash rate target might not much exceed a terminal rate of around 2.5%.

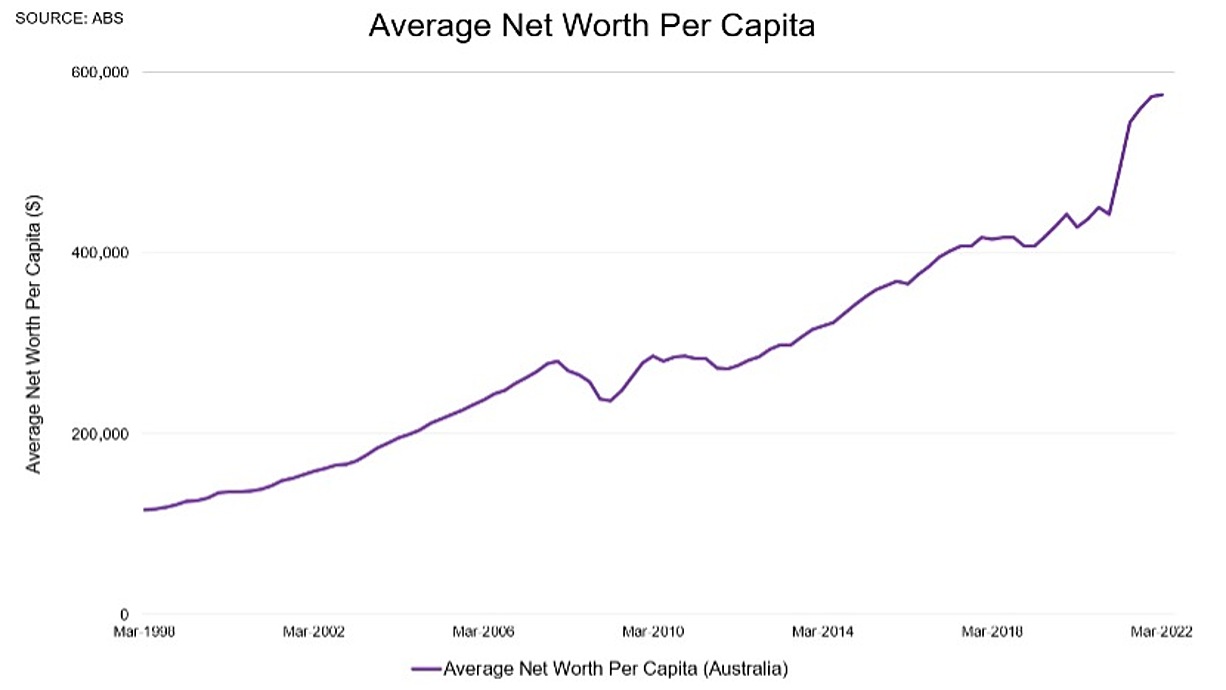

The estimated aggregate value of the residential housing market rose close to $10 trillion in the first quarter of 2022, while household wealth soared to almost $15 trillion.

Australia’s mean net worth per capita has soared ahead of trend through the pandemic to rise by 31% to around $575,000.

With excess household savings also surging to unprecedented levels through the pandemic thanks to a combination of stimulus payments and overseas travel becoming all but impossible for most households, consumers should be able to navigate a balance sheet correction reasonably well given the tight labour market.